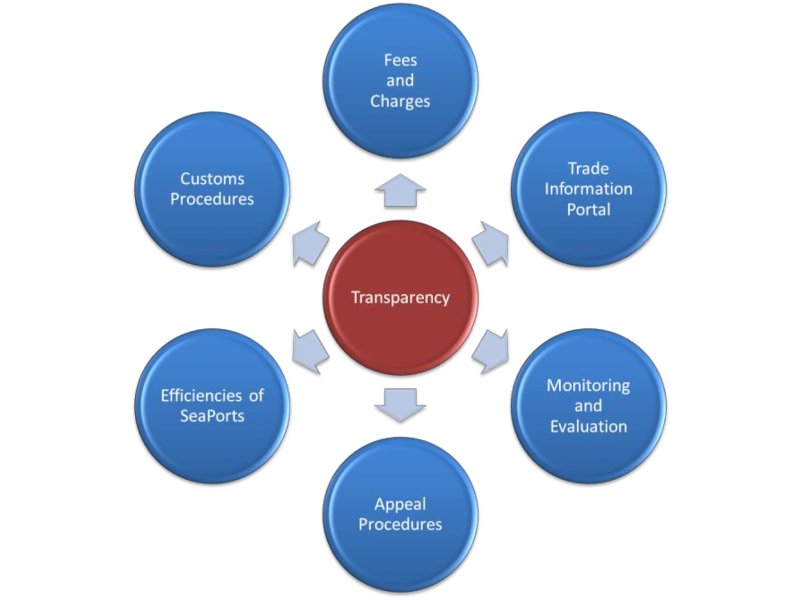

The purpose of activities in the transparency cluster is to ensure that trade laws, regulations, administrative guidelines, and processes are made public and are easily accessible. The figure below summarises the activity areas.

Fees and Charges

Article 6 of the WTO TFA addresses disciplines on fees and charges other than import and export duties and other taxes within the purview of Article III of GATT 1994. Under the Article, WTO Members are to publish information on all fees and charges and amendments; periodically review fees and charges to reduce their number and diversity, where practicable; and limit fees and charges for customs processing to the approximate cost of services rendered on or in connection with a specific import or export operation.

SADC Trade Information Portal (Repository)

Article 1 of the WTO TFA requires that trade regulations, requirements, and procedures be transparent and readily available to interested parties and that parties be given advance notice of and reasonable opportunity to comment on proposed changes.

Article 1:

- Calls for each Member to publish detailed information on import and export operations; transit procedures and restrictions; duties, taxes, and fees; and classification, valuation, and quotas; and

- Specifies information that should be available over the Internet and directs each Member to establish or maintain one or more enquiry points to respond to reasonable enquiries from governments, traders, and other interested parties.

Article 1 focuses on specific customs issues but also encompasses the requirements of other government agencies. Requirements for publicizing import, export, transit, and appeal procedures, as well as restrictions and prohibitions, are not limited to customs. This, and the mention of “other government agencies” with respect to fees and charges, demonstrates a clear intent to include the other border agencies in trade facilitation.

Monitoring and Evaluation of the TFP

The TFP seeks to ensure that activities align with priority areas and proposes monitoring and evaluation to confirm that activities are efficient and effective. The TFP will be reviewed annually taking account of the annual work plans of member States and will be evaluated mid-term and at the end of its five-year span. The SADC Secretariat will provide overall implementation, coordination, review and evaluation of the programme and provide feedback to Member States.

Procedures for Appeal or Review

Article 4 (footnote 4) of the WTO TFA defines an administrative decision as “a decision with a legal effect that affects rights and obligations of a specific person in an individual case” and provides that administrative decisions “include an administrative action within the meaning of Article X of GATT 1994 or failure to take an administrative action or decision as provided for in a Member’s domestic law and legal system”. It further provides that to address such failure, “Members may maintain an alternative administrative mechanism or judicial recourse to direct the Customs authority to promptly issue an administrative decision in place of the right to appeal or review.”

Article 4 requires that each Member shall provide that any person to whom customs issues an administrative decision has the right, within its territory, to (a) administrative appeal or review by an administrative authority higher than or independent of the official or office that issued the decision, and/or (b) judicial appeal or review of the decision. The Article also encourages Members to make its provisions applicable to administrative decisions issued by other border agencies.

Customs Procedures

Best Practices

The WCO Revised Kyoto Convention (RKC) is an international agreement that provides a set of comprehensive Customs procedures intended to facilitate legitimate international trade while effecting Customs controls including the protection of revenues and society (see Section 3.6, Activity 5.4.3 titled Member State Full Accession to Revised Kyoto Convention for further details).

Article 14 of the SADC Protocol on Trade directs Member States to simplify and harmonize trade procedures. SADC Secretariat should survey how Member States are faring in doing so, giving priority to trade facilitation procedures covered by international standards (e.g., at a minimum, pre-arrival processing of import documentation, cargo clearance procedures, risk management administration, post clearance audit and transit processing).

Member States that apply best practices should be publicly recognised and their practices disseminated to other Member States for benchmarking purposes. These same Member States could provide technical assistance to other States (e.g., a country meeting international standards for risk management administration could provide regional technical assistance, mentoring, or other support to other Member States). In addition, regional standards for simplification and harmonization of trade facilitation procedures and processes could be developed on the basis of “best regional practices.”

Specific Customs Regimes

Article 10 of the TFA guides WTO Members in the temporary admission of goods and inward and outward processing. The article states:

a. Temporary Admission of Goods

Each Member shall allow, as provided for in its laws and regulations, goods to be brought into a customs territory conditionally relieved, totally or partially, from payment of import duties and taxes if such goods are brought into a customs territory for a specific purpose, are intended for re-exportation within a specific period, and have not undergone any change except normal depreciation and wastage due to the use made of them.

b. Inward and Outward Processing

- Each Member shall allow, as provided for in its laws and regulations, inward and outward processing of goods. Goods allowed for outward processing may be re- imported with total or partial exemption from import duties and taxes in accordance with the Member’s laws and regulations in force.

- For the purposes of this Article, the term “inward processing” means the customs procedure under which certain goods can be brought into a customs territory conditionally relieved totally or partially from payment of import duties and taxes, or eligible for duty drawback, on the basis that such goods are intended for manufacturing, processing or repair and subsequent exportation.

- For the purposes of this Article, the term “outward processing” means the customs procedure under which goods which are in free circulation in a customs territory may be temporarily exported for manufacturing, processing or repair abroad and then reimported.

The SADC Protocol on Trade does not make specific provision or mention of temporary admission of goods or inward and outward processing. This is an area needing review and oversight to ensure Member States comply with WTO TFA mandates.

Enhancement of the Efficiencies of Seaports

In conducting a diagnostic assessment of seaport operations in the region, SADC [Secretariat] must take into consideration the broader definition for trade facilitation. In doing so, SADC [Secretariat] needs to review or request technical assistance to assess the current procedures and timeframes for the release of cargo from the seaport terminals at the busiest seaport in the region. For the import and transit regimes, the assessment should include the time and steps required from the anchorage of the ship awaiting harbor pilots to release of cargo from the terminal for transport to the consignee, storage in a warehouse or free trade area, or transit movement.

For the export regime, the assessment should include the time and steps required from the request for export authorization, the arrival of the goods to the terminal and the lading on the ship.